"could Halim Saad have done it on his own?" ... in light of his lawsuit ....

my take ... "Could George Bush Junior have done it on his own???"

Sunday, June 16, 2013

Happy Fathers Day

My friend, Roger Wang, who also happens to be one of the country's finest guitarist ... has composed a lovely song for his daughter. Plus he sings, OMG ... that is so rare. The video sets with the lego pieces, must have been such a labour of love ... Wonderful Roger...

This is the most important song I have ever written.

It's also my first vocals outing and first music video that I created myself.

It's also my first vocals outing and first music video that I created myself.

The song was inspired by my daughter's obsession with fairy tales and being a princess. It sums up a lot of my feelings about being a father as well as the hopes and lessons I have for her.

It's often hard for a father to relate to dolls and the way young girls play. Playing Lego together was one of the few activities that we shared. All those hours helped bond us. This video was made with those Lego sets and mini-figures. They became the best way for me to express this song visually.

This song and video come from a very personal place, but it goes out to all fathers and daughters out there, regardless of age.

HAPPY FATHER'S DAY

Saturday, June 15, 2013

Biz News Snippets Worth Following

I read, almost religiously, my favourite business magazines, in order of preference ... International Business Week, Fortune and Bloomberg Markets. I do read Forbes now and then but its such a slanted Republican thingee its like Harakah. I think to see how people from various sides and various places look at and view business and investments help to broaden our perspective no end.

I read, almost religiously, my favourite business magazines, in order of preference ... International Business Week, Fortune and Bloomberg Markets. I do read Forbes now and then but its such a slanted Republican thingee its like Harakah. I think to see how people from various sides and various places look at and view business and investments help to broaden our perspective no end. Since my almost weekly sojourn to Singapore, its also fun to read what the little island's papers are saying about business and investments.

Iskandar

The mood is good for Iskandar. They highlighted how well Affiniti Residences sold last weekend, noting that the price was RM850 to RM1,000 psf. They compared that to 1Medini which as launched in January 2012 and sold for just RM450 psf. Hmmm... whetting yand stirring up Singaporeans to further look at Iskandar as a great investing or flipping hotpot. They seemed focused on the Medini or rather the E&O branding, and they also seem to like Puteri Harbour.

Over the next 3-5 years there will be another 13,500 condos to be sold or built in Iskandar. Compare that to just 8,000 units launched between 2000 and 2012, you get what I am saying. Obviously, the powers to be in Singapore have tacitly approve of Singaporeans to invest big into Iskandar or else you won't be getting big spreads with lovely pics in the papers there. Possibly that is to quell the over investment into Singapore properties, which is already way out of the hands of most Singaporeans.

The supposed mulling over a special property tax by Johor state government seems to have little effect. Its not just Singaporeans though, a Japanese investment fund just bought an entire tower of 285 units at Medini at Iskandar Residences ... somehow I don't think they will be staying there. I wonder, how many will?

My view is that all is well and good for at least the next 12 months when big guns start to launch their flagship property projects. It is the sub-sale and resell or flipping that goes on that is the crux. Will there be people buying on the resale market for 20%-30% higher than the launched price just 6 months ago? It will be very hard to see that happening because of the number of projects that are coming on board. If all are pricing higher at RM900 and upping them to RM1,100 psf because of anticipated demand ... and we are not talking of just 5 or 10 extra condo developments... we are talking about 30 to 40 a year ... its a tough ask to see it snowballing much further. I suspect RM1,300-1,500 psf would be the peak as people will start comparing with prices in Penang and KL.

My view is that all is well and good for at least the next 12 months when big guns start to launch their flagship property projects. It is the sub-sale and resell or flipping that goes on that is the crux. Will there be people buying on the resale market for 20%-30% higher than the launched price just 6 months ago? It will be very hard to see that happening because of the number of projects that are coming on board. If all are pricing higher at RM900 and upping them to RM1,100 psf because of anticipated demand ... and we are not talking of just 5 or 10 extra condo developments... we are talking about 30 to 40 a year ... its a tough ask to see it snowballing much further. I suspect RM1,300-1,500 psf would be the peak as people will start comparing with prices in Penang and KL.The optimists will say look what Singaporean and foreign buyers can do to Sentosa property prices. Well, yeah, do you know how big is Iskandar compared to Sentosa?

The Real QE Poser

Why is the probable end of QE frightening markets? It has to do with interest rates. The selling now has largely been in REITs and dividend yield plays (which include a lot of blue chips). As rates rise from near zero, the yields of these counters will be reassess

ed relatively to the higher risk free yield. What we are seeing is the global portfolio rebalancing. Many funds are reducing their holdings in the above counters appreciably. The other side of the coin is that big banks should benefit from better net interest margins as they usually have a large pool of inert savings, which will not be so easily or swiftly adjusted in the rates. However, we are not seeing a proportionate flow of funds into big banks yet, although it should happen very soon.

We are not going to see a massive correction, in fact, we are already correcting. The markets are discounting all that ahead of time. Markets has to discount what it can forsee or roughly anticipate. In fact, higher interest rates will force funds out of dividend yield plays and into riskier instruments. All said, it is also May June July we are talking about, remember Sell In May Come Back In August ... actually its also summer holidays for a lot of people in the investing field although I doubt that will be as true as the markets are getting more and more global, not US or Europe centric.

Tuesday, June 11, 2013

Wednesday S&M Show Podcast

Share buybacks ... not all good.

http://www.bfm.my/snm-show.html

Libertango (I've Seen That Face Before) - Grace Jones

http://www.bfm.my/snm-show.html

Libertango (I've Seen That Face Before) - Grace Jones

Happy Father's Day - Let The Man Be The Man He Is

I never thought a simple posting like this could have struck so many chords. We all love our mums, and rightly mums get most of the accolade, Mother's Day is always bigger than Father's Day. This posting got xx FB likes, I still cannot believe so many felt the same way. Its like we are so connected in what's deepest in us. I may not know all my readers personally, but I feel so humbled to know you all feel the same way. Its not easy to be a blogger, if there are 100 readers, there'd be 4 or 5 who will just hate your guts and they will post nasty comments to let you know that - even though out of the 100 70 or more may like you, but most will not bother to write and tell you nice things, thats the reality when you put yourself out there ... hence reading the comments for this posting was very shocking and restored my faith in humanity. I thought I had to say this, made me realise what I thought was something simple was probably my most important posting because so many people really cared.

--------------------------------------------------

I had a good chat with a friend about dads growing old. I assume we are all filial sons and daughters. When our dads grow older and older, maybe some will have retired from their careers by now. I wonder how many of us "love our dads" in the way that allows him to continue to be the man that he is.

Dads who are now retired are dads from a different era. Most of our dads are the strong silent types, not like many of the younger dads nowadays who will try to be good friends with their kids.

A man of the house usually takes the lead in the household. He takes care of the paycheck. He calls the shots in many areas of the household matters. When they retire, they may not have access to as much "money as before" - gee, do you ever wonder why, thats because he has brought you guys up, send you guys to further your studies, even finance your first car or even your first home, down payment for this and that. Flying you back from overseas, etc...

Now he may be pushing 60 or 70, he may be living primarily off what you kids give him. We somehow think if we give them a few hundred or a thousand or two ringgit a month, we have done our part. Your dad is still the man he was, faults and all. He used to call the shots, ask you guys where you like to have dinner, ask you guys what you want for your birthdays.

Now, he has to take money from you guys. Funds may not be so "loose". When you guys take him out to dinner, he doesn't have the "right" to pay for you guys anymore. Heck, he may even shy away from ordering whatever he likes from the menu or dictate where he wants to have dinner. He may not even be able to just take your mum wherever they wish to go for holidays.

In these very many small ways, he is not "allowed to be the man he used to be". We as children should empathise with that. If we can afford it, we should give him more than what he needs to survive. We should allow our father to be the father he still is.

A person's spirit is the hardest to please and easiest to break. Love comes in many disguises. Love is not just money but our attitude as well. Reconsider how we love our dads. Mine is no longer around. If your dad still is, be thankful, and be the better son and daughter. Love your dad better.

--------------------------------------------------

I had a good chat with a friend about dads growing old. I assume we are all filial sons and daughters. When our dads grow older and older, maybe some will have retired from their careers by now. I wonder how many of us "love our dads" in the way that allows him to continue to be the man that he is.

Dads who are now retired are dads from a different era. Most of our dads are the strong silent types, not like many of the younger dads nowadays who will try to be good friends with their kids.

A man of the house usually takes the lead in the household. He takes care of the paycheck. He calls the shots in many areas of the household matters. When they retire, they may not have access to as much "money as before" - gee, do you ever wonder why, thats because he has brought you guys up, send you guys to further your studies, even finance your first car or even your first home, down payment for this and that. Flying you back from overseas, etc...

Now he may be pushing 60 or 70, he may be living primarily off what you kids give him. We somehow think if we give them a few hundred or a thousand or two ringgit a month, we have done our part. Your dad is still the man he was, faults and all. He used to call the shots, ask you guys where you like to have dinner, ask you guys what you want for your birthdays.

Now, he has to take money from you guys. Funds may not be so "loose". When you guys take him out to dinner, he doesn't have the "right" to pay for you guys anymore. Heck, he may even shy away from ordering whatever he likes from the menu or dictate where he wants to have dinner. He may not even be able to just take your mum wherever they wish to go for holidays.

In these very many small ways, he is not "allowed to be the man he used to be". We as children should empathise with that. If we can afford it, we should give him more than what he needs to survive. We should allow our father to be the father he still is.

A person's spirit is the hardest to please and easiest to break. Love comes in many disguises. Love is not just money but our attitude as well. Reconsider how we love our dads. Mine is no longer around. If your dad still is, be thankful, and be the better son and daughter. Love your dad better.

Monday, June 10, 2013

Have A Good Look At Cypark Resources

The market has been focused on oil & gas, marginal oilfields, Iskandar plays and even Penang's Second Bridge plays. Running out of ideas? So are the analysts. Still, there are gems to be found, and one of them is in Renewable Energy, Cypark Resources.

Cypark Resources Berhad is a Malaysia-based company engaged in the provision of environmental technology and engineering solutions to both the private and public sectors. Its services include transforming neglected, degraded or contaminated land into sustainable and manageable fields. Its projects include the restoration of a disused mining land in Cyberpark, Cyberjaya, and the Taman Beringin Safe Landfill Restoration project in Kuala Lumpur.

It has three segments: landscaping, which is engaged in the provision of landscape services for public parks, public amenities and other landscaping developments; maintenance, which is engaged in the provision of maintenance services for public parks, public amenities and other landscape developments, and environmental, which is engaged in the provision of nature conservation and environmental amelioration. In September 2011, it acquired Cypark Suria (Sua Betong) Sdn. Bhd., Cypark Suria (Kuala Sawah) Sdn. Bhd. and Cypark Suria (Bukit Palong) Sdn.

The company is pumping up the revenue platform, hence if you focused solely on reported numbers you may miss the bigger picture. 1Q13 revenue rose by 20.6% to RM51m due to the start of Cypark's solar farm in Pajam and higher revenue from its waste-to-energy projects. At the same time, total costs rose by 26.8% to RM39.7m as the company is aggressively putting up RE projects around Malaysia. Management aims to add 15MW of RE capacity in FY13, mainly in 2H. This will increase Cypark's total RE capacity by 83% to 33MW by end-FY13. The higher start-up cost has offset Cypark's top-line growth, leading to a 6.4% decline in EBIT to RM10.1m.

The stock could be catalysed by the successful rollout of new renewable energy (RE) projects and signing of the Ladang Tanah Merah landfill concession. In addition to its MoU in Myanmar, Cypark can replicate its

RE model in other Asean countries such as Thailand, which already has a feed-in-tariff mechanism in place.

Cypark Resources Berhad is a Malaysia-based company engaged in the provision of environmental technology and engineering solutions to both the private and public sectors. Its services include transforming neglected, degraded or contaminated land into sustainable and manageable fields. Its projects include the restoration of a disused mining land in Cyberpark, Cyberjaya, and the Taman Beringin Safe Landfill Restoration project in Kuala Lumpur.

It has three segments: landscaping, which is engaged in the provision of landscape services for public parks, public amenities and other landscaping developments; maintenance, which is engaged in the provision of maintenance services for public parks, public amenities and other landscape developments, and environmental, which is engaged in the provision of nature conservation and environmental amelioration. In September 2011, it acquired Cypark Suria (Sua Betong) Sdn. Bhd., Cypark Suria (Kuala Sawah) Sdn. Bhd. and Cypark Suria (Bukit Palong) Sdn.

The company is pumping up the revenue platform, hence if you focused solely on reported numbers you may miss the bigger picture. 1Q13 revenue rose by 20.6% to RM51m due to the start of Cypark's solar farm in Pajam and higher revenue from its waste-to-energy projects. At the same time, total costs rose by 26.8% to RM39.7m as the company is aggressively putting up RE projects around Malaysia. Management aims to add 15MW of RE capacity in FY13, mainly in 2H. This will increase Cypark's total RE capacity by 83% to 33MW by end-FY13. The higher start-up cost has offset Cypark's top-line growth, leading to a 6.4% decline in EBIT to RM10.1m.

The stock could be catalysed by the successful rollout of new renewable energy (RE) projects and signing of the Ladang Tanah Merah landfill concession. In addition to its MoU in Myanmar, Cypark can replicate its

RE model in other Asean countries such as Thailand, which already has a feed-in-tariff mechanism in place.

| Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions. |

Saturday, June 8, 2013

Action, Reaction, Inaction ... Karmatic

This video is about an island in the ocean at 2000 km from any other coast line. Nobody lives, only birds and yet, you will not believe what you will see here.

Please don't throw anything into the sea. Unbelievable, just look at the consequences.

Please don't throw anything into the sea. Unbelievable, just look at the consequences.

Thursday, June 6, 2013

Asset Class Returns As At 31 May 2013

This is highly interesting. As a test, if you were looking at the table what could you say or what kind of observations could you make. Not trying to be an asshole or "guru" here, but if you are honest about your knowledge of markets, the ability to synthesize data and tell a story, you should do well in financial markets. If you can't, then you shouldn't be, or are just plodding along. To be in the markets you can study, but you have to have passion for it. Make your own observations before scrolling down.

- The one month data does not tell us much.

- YTD, the equity markets have been well led by the US, in fact emerging markets have been trailing ... suffice to say that most of the Asian markets which have been surging so far this year have been an anomaly, which further depresses the real performance of other emerging markets.

- We know the financial markets have been awashed in liquidity with QEs from various central banks, but where have they been headed. The YTD figures are again revealing, some have exited gold in a big way. Them taking money off gold may be just profit taking or likely to mean they are more comfortable that currencies won't be debased anymore, or that bailouts have finally went past a peak. The reduction of fear or volatility could be another reason.

- So where is the liquidity? They went largely into US stocks, US REITs and even foreign REITs. The REITs interest is but a reflection in a strong bottoming in property price correction and a resurrection of demand, and also a hint that people are more employable even now to take up new mortgages, and/or that a lot more PE/VC/vulture funds are taking advantage and making deals on distressed commercial properties.

- Look at crude oil, one month, YTD or 1 year even, that is a good reflection about the robustness (or lack of) of the global economic recovery. The recovery is benign and in patches still.

- Look at commodities, again the same conclusion as for crude oil, still working of excess inventory in the global system.

- Look at the emerging equity markets from 1 year ago, there has been a dramatic shift away from emerging markets back to US and possibly Japanese stocks. Again the robust performance of other Asian equity markets is very telling as it is viewed as largely unscathed and the equity markets there do attract sufficient interest compared to other emerging markets.

- The most important point one has to conclude is a drastic shift away from bonds of all kind. Bonds have been great on a 3 year basis but more funds are moving out. They move out because they either think there is a bubble there (too safe, and too many people willing to pay too high a price for low yields) and/or equity provides a better return even after accounting for risk.

From the above, I am quite confident that the current sell down in equities will be brief.

- The one month data does not tell us much.

- YTD, the equity markets have been well led by the US, in fact emerging markets have been trailing ... suffice to say that most of the Asian markets which have been surging so far this year have been an anomaly, which further depresses the real performance of other emerging markets.

- We know the financial markets have been awashed in liquidity with QEs from various central banks, but where have they been headed. The YTD figures are again revealing, some have exited gold in a big way. Them taking money off gold may be just profit taking or likely to mean they are more comfortable that currencies won't be debased anymore, or that bailouts have finally went past a peak. The reduction of fear or volatility could be another reason.

- So where is the liquidity? They went largely into US stocks, US REITs and even foreign REITs. The REITs interest is but a reflection in a strong bottoming in property price correction and a resurrection of demand, and also a hint that people are more employable even now to take up new mortgages, and/or that a lot more PE/VC/vulture funds are taking advantage and making deals on distressed commercial properties.

- Look at crude oil, one month, YTD or 1 year even, that is a good reflection about the robustness (or lack of) of the global economic recovery. The recovery is benign and in patches still.

- Look at commodities, again the same conclusion as for crude oil, still working of excess inventory in the global system.

- Look at the emerging equity markets from 1 year ago, there has been a dramatic shift away from emerging markets back to US and possibly Japanese stocks. Again the robust performance of other Asian equity markets is very telling as it is viewed as largely unscathed and the equity markets there do attract sufficient interest compared to other emerging markets.

- The most important point one has to conclude is a drastic shift away from bonds of all kind. Bonds have been great on a 3 year basis but more funds are moving out. They move out because they either think there is a bubble there (too safe, and too many people willing to pay too high a price for low yields) and/or equity provides a better return even after accounting for risk.

From the above, I am quite confident that the current sell down in equities will be brief.

Tuesday, June 4, 2013

Wednesday Podcast S&M Show

http://www.bfm.my/snm-show.html

Long term investing vs short term ..... and Llorando by Rebekah del Rio.

Long term investing vs short term ..... and Llorando by Rebekah del Rio.

The Fears Of The End Of Quant Easing

Markets everywhere have been shaken over the last two weeks. First was the correction in the Japanese equity markets. It has lost substantial ground over just the last couple of weeks. Next came the Bernanke's testimony which led all to conclude that QE would be ending soon.

If an article in Monday's Wall Street Journal is anything to go by, the U.S. Federal Reserve is getting ready to unwind its massive monetary stimulus program. So, is that prospect as alarming for financial markets as feared?

If an article in Monday's Wall Street Journal is anything to go by, the U.S. Federal Reserve is getting ready to unwind its massive monetary stimulus program. So, is that prospect as alarming for financial markets as feared?

Fed officials have mapped out a strategy to wind down its $85 billion-a-month bond-buying program in careful steps, although the timing of when that will start is still being debated, noted Fed watcher Jon Hilsenrath wrote in the WSJ.

Any unwinding of the Fed's quantitative easing (QE) program, which has fueled a rally in equity markets and other risk assets, is generally viewed as negative and any indication of this happening has been highly anticipated in the U.S. since late last week.

"Having spent two New York sessions pricing in a sharp change in Fed stance, it is not obvious that the article was worth the wait," analysts at Westpac said in a note. "The timing of the unwinding of QE remains data-dependent, not a serious prospect until perhaps late U.S. summer at the earliest."

Analysts say that in essence, the Fed appears to be managing market expectations that its quantitative easing program will not last forever. The Fed has said that it would maintain its key interest rate between zero and 0.25 percent until the unemployment rate fell to 6.5 percent. It has also committed to monthly purchases of bonds until labor market conditions improve substantially.

And it is the recent signs of improvement in the jobs market that has renewed talk about a possible end to the quantitative easing. The latest non-farm payrolls report showed the U.S. economy created 165,000 new jobs last month, much more than expected, helping push the unemployment rate down to 7.5 percent. Data last week meanwhile showed jobless claims at their lowest level in almost 5-1/2 years.

It looks like the markets are just grabbing at excuses to do a bit of sell down after a spectacular run in most equity markets since the beginning of the years. The timing is still a bit uncertain, but seriously folks, the end game only looks to peter out by December this year. It is very good that markets are readying itself for the end of QE.

The Fed officials are not going to raise interest rates until unemployment comes down to 6.5 percent, and could only come earliest by 1st quarter of next year. What is likely to happen is when unemployment dips below 7%, we may see a scaling back from the $85 billion buyback figure to maybe halve that.

The Fed officials are not going to raise interest rates until unemployment comes down to 6.5 percent, and could only come earliest by 1st quarter of next year. What is likely to happen is when unemployment dips below 7%, we may see a scaling back from the $85 billion buyback figure to maybe halve that.

The knee jerkers would be better off looking at the positives:

- That [an easing of QE] would be good for U.S. stocks because it would mean the U.S. economy is doing a lot better.

- That at least markets are already trying to price in the end of QE, instead of a surprising one off massive sell down.

The last part is very important as we can easily reference to the 1994 massive sell down, just because Alan Greenspan never gave any indication as to the imminent rise of interest rates in the US. That experience probably forms the backdrop for Bernanke's communication strategy. He is managing expectations very well. By putting it out there with the 6.5% unemployment target, it allows all to see the looming horizon.

I still think halving the buyback when unemployment dips below 7% would be an excellent strategy to manage expectations further. Everyone knows QE cannot be there forever.

I like the equity markets now more than in the beginning of the year. Japan has corrected substantially even though Abenomics will still be in the works. This will drive Japan to retests its high this year soon enough. I believe the sell down was a good profit taking exercise and actually allowing a lot of stale bulls (i.e. those holding onto Japanese shares for over 20 years) to exit - all that will come back to the market place for sure.

The local Malaysian equity market has held up better than the rest, and confidence breeds confidence. Having said that, Malaysia is only up 4.6% so far this, thanks to the uncertainty over the elections period. Other Asian markets have risen a lot more, and hence had more room for downside: Indonesia 15.2%, the Philippines 16.4% and Thailand 10.6%.

If an article in Monday's Wall Street Journal is anything to go by, the U.S. Federal Reserve is getting ready to unwind its massive monetary stimulus program. So, is that prospect as alarming for financial markets as feared?

If an article in Monday's Wall Street Journal is anything to go by, the U.S. Federal Reserve is getting ready to unwind its massive monetary stimulus program. So, is that prospect as alarming for financial markets as feared?Fed officials have mapped out a strategy to wind down its $85 billion-a-month bond-buying program in careful steps, although the timing of when that will start is still being debated, noted Fed watcher Jon Hilsenrath wrote in the WSJ.

Any unwinding of the Fed's quantitative easing (QE) program, which has fueled a rally in equity markets and other risk assets, is generally viewed as negative and any indication of this happening has been highly anticipated in the U.S. since late last week.

"Having spent two New York sessions pricing in a sharp change in Fed stance, it is not obvious that the article was worth the wait," analysts at Westpac said in a note. "The timing of the unwinding of QE remains data-dependent, not a serious prospect until perhaps late U.S. summer at the earliest."

Analysts say that in essence, the Fed appears to be managing market expectations that its quantitative easing program will not last forever. The Fed has said that it would maintain its key interest rate between zero and 0.25 percent until the unemployment rate fell to 6.5 percent. It has also committed to monthly purchases of bonds until labor market conditions improve substantially.

And it is the recent signs of improvement in the jobs market that has renewed talk about a possible end to the quantitative easing. The latest non-farm payrolls report showed the U.S. economy created 165,000 new jobs last month, much more than expected, helping push the unemployment rate down to 7.5 percent. Data last week meanwhile showed jobless claims at their lowest level in almost 5-1/2 years.

It looks like the markets are just grabbing at excuses to do a bit of sell down after a spectacular run in most equity markets since the beginning of the years. The timing is still a bit uncertain, but seriously folks, the end game only looks to peter out by December this year. It is very good that markets are readying itself for the end of QE.

The Fed officials are not going to raise interest rates until unemployment comes down to 6.5 percent, and could only come earliest by 1st quarter of next year. What is likely to happen is when unemployment dips below 7%, we may see a scaling back from the $85 billion buyback figure to maybe halve that.

The Fed officials are not going to raise interest rates until unemployment comes down to 6.5 percent, and could only come earliest by 1st quarter of next year. What is likely to happen is when unemployment dips below 7%, we may see a scaling back from the $85 billion buyback figure to maybe halve that. The knee jerkers would be better off looking at the positives:

- That [an easing of QE] would be good for U.S. stocks because it would mean the U.S. economy is doing a lot better.

- That at least markets are already trying to price in the end of QE, instead of a surprising one off massive sell down.

The last part is very important as we can easily reference to the 1994 massive sell down, just because Alan Greenspan never gave any indication as to the imminent rise of interest rates in the US. That experience probably forms the backdrop for Bernanke's communication strategy. He is managing expectations very well. By putting it out there with the 6.5% unemployment target, it allows all to see the looming horizon.

I still think halving the buyback when unemployment dips below 7% would be an excellent strategy to manage expectations further. Everyone knows QE cannot be there forever.

I like the equity markets now more than in the beginning of the year. Japan has corrected substantially even though Abenomics will still be in the works. This will drive Japan to retests its high this year soon enough. I believe the sell down was a good profit taking exercise and actually allowing a lot of stale bulls (i.e. those holding onto Japanese shares for over 20 years) to exit - all that will come back to the market place for sure.

The local Malaysian equity market has held up better than the rest, and confidence breeds confidence. Having said that, Malaysia is only up 4.6% so far this, thanks to the uncertainty over the elections period. Other Asian markets have risen a lot more, and hence had more room for downside: Indonesia 15.2%, the Philippines 16.4% and Thailand 10.6%.

Monday, June 3, 2013

My Life's Aphorisms

Readers of my blog will notice that I haven't been updating my blog lately ... usually I am pretty not that busy ... now I have to go to Singapore every week for a couple of days ... and then there are the many meetings that suddenly crop up and classes that I have to give for Murasaki ... blah blah ... I miss writing my blog, I love it because its like a diary of sorts, I cannot ignore my blog cause its now 6 years of my life. If anyone reads it carefully, they would know me very well cause I never write to create a false persona, if you think I am an asshole, you are probably right. I don't like to be busy, it makes time flies, and I don't get to sit and relax and enjoy. My Monday nights drinks sessions are sacred, those of you who are part of it knows too well. We all have to slow things down and take stock of what we are doing, whether they correlate to fulfillment of your goals in life, so I think its time to re-look my own aphorisms in life, making sure I stay centered amidst the noise.

--------------------------------

Don't aim just to be rich, aim to create wealth, create better lives, create better livelihoods for people, create jobs where others can contribute to society and be a useful participant.

Use your wealth to fund your passions and causes, and don't forget to enjoy yourself in the process.

Stand up for injustice, for the downtrodden, for those who cannot help themselves. Aim for equality for all, in all.

Have a zest for good things, finer things in life, its OK to to enjoy.

Surround yourself with positive people. Make sure your life partner is enthusiastic, have energy for life, and empathy for people, friends and family.

Don't wait for fate or destiny to affect your life, its your life, make it happen.

Finding something or someone that/who means more to you than yourself.

Make a conscious effort not to hold onto people who don't love us or people who hate us or people who make us mad or people who take us for granted ... we also care too little for the people who love us unconditionally, the people who adore us, the ones who still stick around in spite of all your shortcomings.

Make an effort to to live healthy for yourself and the people who care for you. Live long but more importantly live well.

Make a conscious effort to better the lives of the people around you, your family and circle of close friends.

Bloom where you are planted, not whine about why you are where you are.

--------------------------------

Don't aim just to be rich, aim to create wealth, create better lives, create better livelihoods for people, create jobs where others can contribute to society and be a useful participant.

Use your wealth to fund your passions and causes, and don't forget to enjoy yourself in the process.

Stand up for injustice, for the downtrodden, for those who cannot help themselves. Aim for equality for all, in all.

Have a zest for good things, finer things in life, its OK to to enjoy.

Surround yourself with positive people. Make sure your life partner is enthusiastic, have energy for life, and empathy for people, friends and family.

Don't wait for fate or destiny to affect your life, its your life, make it happen.

Finding something or someone that/who means more to you than yourself.

Make a conscious effort not to hold onto people who don't love us or people who hate us or people who make us mad or people who take us for granted ... we also care too little for the people who love us unconditionally, the people who adore us, the ones who still stick around in spite of all your shortcomings.

Make an effort to to live healthy for yourself and the people who care for you. Live long but more importantly live well.

Make a conscious effort to better the lives of the people around you, your family and circle of close friends.

Bloom where you are planted, not whine about why you are where you are.

Wednesday, May 29, 2013

S&M Show Podcast

New SPACs - Terragali & Australaysia; Goldis-IGB; Excessive directors' compensation.

http://www.bfm.my/sm-salvatore-dali-malaysiafinance-spacs-overpaid-directors.html

http://www.bfm.my/snm-show.html

http://www.bfm.my/sm-salvatore-dali-malaysiafinance-spacs-overpaid-directors.html

http://www.bfm.my/snm-show.html

Tuesday, May 28, 2013

Saturday, May 25, 2013

Why So Few Female Traders

When you speak off the cuff, silly sounding things can pop out. Thats why I am so reluctantly to speak quickly over the radio, and I need pauses so that i don't say things such as those said by Paul Tudor Jones.

For a billionaire hedge fund manager who carefully manages his public image, Paul Tudor Jones had a minor crisis on his hands. Mr. Jones, a billionaire and philanthropist of legendary stature in the minds of many Wall Street traders, was forced on Thursday to explain what he meant in remarks that surfaced in a video published by The Washington Post. The video, depicting a University of Virginia symposium in April, shows Mr. Jones trying to explain why there is a scarcity of female traders.

“As soon as that baby’s lips touch that girl’s bosom, forget it,” Mr. Jones, who has three daughters, says in the video. “Every single investment idea, every desire to understand what’s going to make this go up or go down, is going to be overwhelmed by the most beautiful experience, which a man will never share, about a mode of connection between that mother and that baby.”

“I’ve just seen it happen over and over,” he added. “I’m talking about trading, not managing.” The video was obtained through a Freedom of Information Act request.

His comments went viral online and were widely criticized. In an e-mail sent to news outlets, Mr. Jones said he was speaking “off the cuff” and referring in particular to “global macro traders,” who work across multiple markets.

“Macro trading requires a high degree of skill, focus and repetition,” Mr. Jones said by way of clarification. “Life events, such as birth, divorce, death of a loved one and other emotional highs and lows are obstacles to success in this specific field of finance.” He added that success was possible “as long as a woman or man has the skill, passion, and repetitions to work through the inevitable life events that arise along the way.”

The episode was an uncomfortable turn for Mr. Jones, who earlier this month was called a “modern-day Robin Hood” by CBS News’s “60 Minutes” in a report on the financier’s charitable foundation.

Watching the video, there was a “pit in my stomach of how 1950s that is,” Alexandra Lebenthal, chief executive of the financial firm Lebenthal & Company, said on MSNBC’s “Morning Joe” on Friday.

“I’m not sure that bonding experience of breastfeeding is all that wonderful,” Ms. Lebenthal added.

Joanna Coles, editor in chief of Cosmopolitan, said on MSNBC: “What you see in this is actually what a lot of men on Wall Street still actually think.”

Mr. Jones’s theory is “scientifically unsound,” Simone Foxman said in Quartz. “Women don’t produce as much cortisol when in risky situations and therefore — theoretically at least — aren’t as likely to be as overwhelmed by negative emotions.”

My View is that there is some truth in it, but very little in effect. Let's be honest, Paul is not the person who created the financial trading system, he merely commented on the reality. Truth be told, most good traders who happen to be men, are also mostly dead inside. Nuff said. The ability to focus and block out other thoughts and considerations are paramount to be a great trader. Let's be frank, how many of us can do that without our minds wondering and wandering. Great traders usually have very empty lives, have to keep drowning their hollow soul with liquor and checking their bank balance gives them the kind of temporary adrenaline high to remind themselves falsely that what they are doing is worthwhile.

The reason why most great traders are men lies in the society structure and biases - men still have certain advantages in terms of "old boys network", and preferential treatment when hiring traders. The whole system is geared towards a brutal Darwinian elimination process. Only the good survive the industry. When you have 980 men and 20 women in trading positions to start with ... isn't it normal to see the top ten traders being largely men, maybe 9/10 or even 10/10.

For a billionaire hedge fund manager who carefully manages his public image, Paul Tudor Jones had a minor crisis on his hands. Mr. Jones, a billionaire and philanthropist of legendary stature in the minds of many Wall Street traders, was forced on Thursday to explain what he meant in remarks that surfaced in a video published by The Washington Post. The video, depicting a University of Virginia symposium in April, shows Mr. Jones trying to explain why there is a scarcity of female traders.

“As soon as that baby’s lips touch that girl’s bosom, forget it,” Mr. Jones, who has three daughters, says in the video. “Every single investment idea, every desire to understand what’s going to make this go up or go down, is going to be overwhelmed by the most beautiful experience, which a man will never share, about a mode of connection between that mother and that baby.”

“I’ve just seen it happen over and over,” he added. “I’m talking about trading, not managing.” The video was obtained through a Freedom of Information Act request.

His comments went viral online and were widely criticized. In an e-mail sent to news outlets, Mr. Jones said he was speaking “off the cuff” and referring in particular to “global macro traders,” who work across multiple markets.

“Macro trading requires a high degree of skill, focus and repetition,” Mr. Jones said by way of clarification. “Life events, such as birth, divorce, death of a loved one and other emotional highs and lows are obstacles to success in this specific field of finance.” He added that success was possible “as long as a woman or man has the skill, passion, and repetitions to work through the inevitable life events that arise along the way.”

The episode was an uncomfortable turn for Mr. Jones, who earlier this month was called a “modern-day Robin Hood” by CBS News’s “60 Minutes” in a report on the financier’s charitable foundation.

Watching the video, there was a “pit in my stomach of how 1950s that is,” Alexandra Lebenthal, chief executive of the financial firm Lebenthal & Company, said on MSNBC’s “Morning Joe” on Friday.

“I’m not sure that bonding experience of breastfeeding is all that wonderful,” Ms. Lebenthal added.

Joanna Coles, editor in chief of Cosmopolitan, said on MSNBC: “What you see in this is actually what a lot of men on Wall Street still actually think.”

Mr. Jones’s theory is “scientifically unsound,” Simone Foxman said in Quartz. “Women don’t produce as much cortisol when in risky situations and therefore — theoretically at least — aren’t as likely to be as overwhelmed by negative emotions.”

My View is that there is some truth in it, but very little in effect. Let's be honest, Paul is not the person who created the financial trading system, he merely commented on the reality. Truth be told, most good traders who happen to be men, are also mostly dead inside. Nuff said. The ability to focus and block out other thoughts and considerations are paramount to be a great trader. Let's be frank, how many of us can do that without our minds wondering and wandering. Great traders usually have very empty lives, have to keep drowning their hollow soul with liquor and checking their bank balance gives them the kind of temporary adrenaline high to remind themselves falsely that what they are doing is worthwhile.

The reason why most great traders are men lies in the society structure and biases - men still have certain advantages in terms of "old boys network", and preferential treatment when hiring traders. The whole system is geared towards a brutal Darwinian elimination process. Only the good survive the industry. When you have 980 men and 20 women in trading positions to start with ... isn't it normal to see the top ten traders being largely men, maybe 9/10 or even 10/10.

Thursday, May 23, 2013

The Silent Movie Man - Speaks For All

Everyone has seen some Charlie Chaplin movies, they were great and still are. That alone would have suffice in leaving a wonderful legacy of a life well lived. Not many has even heard of him speak, but if you watch his only snippet from The Great Dictator, where he spoke in his movie for the first and only time, ever ... you know he has an even greater soul. While disguised as part of a movie script, its blatantly obvious that he chose that one instance, that one platform to voice his important empathetic view - funny how much of that speech is still so relevant for so many people in so many places, ours included.

Good day to you, Sir Charlie Chaplin ....

Another example of his great talent, he composed the music to Smile ... Michael Jackson's favourite song of all time. Charlie Chaplin, a man so devoted to make us all laugh, must have known what hurt is to come up with these two important contributions during his life on earth.

Good day to you, Sir Charlie Chaplin ....

Another example of his great talent, he composed the music to Smile ... Michael Jackson's favourite song of all time. Charlie Chaplin, a man so devoted to make us all laugh, must have known what hurt is to come up with these two important contributions during his life on earth.

Wednesday, May 22, 2013

Tuesday, May 21, 2013

Gotta Watch This - Miyoko Shida Rigolo

This is an exceptional piece of performance art. In fact, it is so much more than just exhibiting the powers of concentration. It is art definitely, loaded with meanings and inflections. The inter-connectedness of everything in life, its delicate balance ... seemingly unimportant (feather) yet it holds everything together. Its beautiful, moving and thought provoking.

Saturday, May 18, 2013

New Darling Stock In The Making?

Now we get an idea of whats been driving up the shares of Instacom. The Company also released its first quarter results last Tuesday with revenue of RM30.2m and PAT of RM6.8m. Annualising its PAT would yield a projected year end profits of RM27.2m.

At last Friday's close of 39.5c, that's a PE of 10 times, which for a growth stock in an exciting rapidly growing and constantly transforming telecommunications industry is fairly reasonable. Some may argue its still cheap as PE of 15 to 18 times is normally par for course for the Telco industry across the region. That would translate in to a price range of 58c to 68c.

This has not even factored in the earnings contribution from the RM205m as highlighted in the STAR or EDGE today yet. Potentially Instacom can be a GEM as a valued investment stock. You do the calculations and derive your own conclusion based on your risk averse outlook and your balanced portfolio considerations.

If you assume that it yields just 15% net margins over 3 years, that is RM30.75m or roughly an additional RM10m net a year.

Current number of 20 sen shares: 702.25m

For argument's sake, lets just take RM6m net per quarter, annualised = RM24m

Plus the new project = RM10m = RM34m

Net EPS = 4.8 sen

40 sen 8.3x

45 sen 9.3x

50 sen 10.4x

55 sen 11.4x

60 sen 12.5x

The other question is whether the project is a one off. If you look into the telcos' plans, there are nearly every single telco (Celcom, Maxis, DIGI, etc..) plans to spend an additional RM300m -RM1bn each over the next 12 months. It would be silly to think they would not be getting some of these as the company is heads and shoulders above the rest in its sub-industry in terms of time execution and delivery of projects.

The company could very well be the new darling stock for the rest of the year.

| Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions. | |||||||

Thursday, May 16, 2013

Finally, .... 101 Proposals

Finally, somebody has decided to remake my all time favourite TV series, the Japanese romantic comedy 101 Proposal. You will cry buckets and laugh like a lunatic if you have watched it before. The remake is a China production with Lin Chiling, whom I have never thought to be much of a talent, but did well. The always funny and self deprecating Bo Huang. To consolidate a TV series into a movie is never an easy task, but its pretty good.

If you have a few hours to spend, go watch the entire 12 episodes on You Tube. I have linked the first episode at the bottom (yes, got English subtitles).

The original 101st Marriage Proposal is a "Beauty and the Beast" story starring Takeda Tetsuya (Virgin Road, 3 nen B gumi Kinpachi Sensei) as a down-on-his-luck man who has gone through 99 omiai (arranged dates with the intention of marriage if the date goes well). Not particularly smart, nor handsome, nor rich, he is a man who cannot lie and of course, has a heart of pure gold. On the 100th omiai, he meets Kaoru (Asano Atsuko), an extremely beautiful and talented cellist who can't forget her dead fiancee.

So, Takeda has had 100 arranged dates with marriage in mind setting but its the 100th date that caused him to abandon the "arranged marriage" mentality and pursue true love and devotion. The entire series has him trying to pursue the girl and failing and failing, with comical results. Besides the many things that were seemingly incompatible, she cannot love again as she fears anyone she loves will die on her again like her fiancee. Why is the thing called 101 Proposals ... well ... the 101th proposal is by the girl asking Takeda to marry her, thats why.

Its such an iconic series helped by the ever brilliant Chage & Aska theme song Say Yes which can be heard throughout the series and also in the new Mandarin remake. A side note, am I the only one to notice that Takeda Tetsuya, the original lead, made a cameo appearance as the husband of the girl's teacher from Japan - what a gem of cinematic kismet.

The series was made back in 1991 ... but you can certainly see and count how many more recent movies have stolen ideas left right and center from the series ... HK, China, Korea, America...

If you do not have the time to watch the movie or the series, well at least watch the final 14 minutes of the original series ending as they provide the entire flashback of the courtship and ending. The series is infinitely better as its like 12 movies, and there are many great relationships .... the most touching is between Takeda and his good looking brother.

Watch the whole original series, start with Episode 1, there are 12. If English subtitles are not showing, look for the Caption button and turn to English.

Wednesday, May 15, 2013

Tuesday, May 14, 2013

Instacom, Garnering Good Interest

The company was listed via a RTO last year and had stayed relatively quiet for some time. What was interesting was that the company's share price started edging up even before the recent elections was over. To do that, I think the buyers must be confident of the prospects for the company. It has continued to move upwards and appears to be consolidating its gains for the past couple of days.

Last night, Instacom Group Berhad (IGB)’s financial performance continued where it left off from the last quarter to record continued strong growth during the first quarter of 2013. In an announcement to Bursa Malaysia this evening, IGB said that, for the current financial quarter ended 31 March 2013, the Group recorded revenue of RM30.210 million and profit before tax of RM6.828 million. Against the previous corresponding period, these numbers represent significant increases of RM29.350 million and RM9.895 million, respectively.

The earnings jump is significant as the company had guaranteed at least RM15m in profits following the RTO exercise. It looks likely that that figure will be easily breached.

Besides being probably the best telco backend infra company, the company has its roots in East Malaysia, which should see a substantial deployment of investment to further enhance the connectivity and penetration in East Malaysia, hence they should be a prime beneficiary there.

Another aspect which they are currently looking at is the potential to move into ownership of telecom assets. They are looking into a tower REIT as an option. They have already started acquiring such assets and should make an announcement to monetise them in the near future.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

Last night, Instacom Group Berhad (IGB)’s financial performance continued where it left off from the last quarter to record continued strong growth during the first quarter of 2013. In an announcement to Bursa Malaysia this evening, IGB said that, for the current financial quarter ended 31 March 2013, the Group recorded revenue of RM30.210 million and profit before tax of RM6.828 million. Against the previous corresponding period, these numbers represent significant increases of RM29.350 million and RM9.895 million, respectively.

IGB Chief Executive Officer Anne Kung described the Q1 financial performance as “sterling and reflects how hard we are working in our quest for operational excellence and maximizing returns for all shareholders.”

The telecommunications industry is growing in leaps and bounds as Malaysia moves into the LTE (long term evolution) era with major operators looking to expand their data earnings. Mobile data traffic in Malaysia should double this year in line with the global trend,” she said, quoting a recent report by telecoms equipment firm Ericsson which foresees mobile data volumes rising by a compound annual growth rate of around 50% between 2012 and 2018.

The earnings jump is significant as the company had guaranteed at least RM15m in profits following the RTO exercise. It looks likely that that figure will be easily breached.

Besides being probably the best telco backend infra company, the company has its roots in East Malaysia, which should see a substantial deployment of investment to further enhance the connectivity and penetration in East Malaysia, hence they should be a prime beneficiary there.

Another aspect which they are currently looking at is the potential to move into ownership of telecom assets. They are looking into a tower REIT as an option. They have already started acquiring such assets and should make an announcement to monetise them in the near future.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

Monday, May 13, 2013

Stocks To Watch

The market has been trying to fill the gap to its recent high. Local investors are putting their money to work. The prevailing themes are still oil and gas and Iskandar as expected. However we cannot be buying each and every share that moves. Here are a few for your consideration. Nobody should be bitching about the price chart trend, of course its up already. No point looking at laggards, not their time yet plus the market has not reached a level whereby we should be looking at laggards yet.

Hiap Teck - Good volume formation.

Wah Seong - This one got some legs even though the spike has been significant. Instead of looking at the beneficiaries of marginal oil fields contracts, one should really look at pipe coating specialist such as Wah Seong, under the radar for too long.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

Hiap Teck - Good volume formation.

Wah Seong - This one got some legs even though the spike has been significant. Instead of looking at the beneficiaries of marginal oil fields contracts, one should really look at pipe coating specialist such as Wah Seong, under the radar for too long.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

Saturday, May 11, 2013

Why Khalid For MB Selangor

Tan Sri Khalid may not be as charismatic as many other seasoned politicians, his contribution is to run Selangor state coffers in a most prudent way. There are many things a MB cannot do if they are under the purview of the Federal government - e.g. the Police on crime rates, tax rates for various things ... I do think he should come down harder on a lot of shenanigans still in the local councils, city councils, etc...

Thursday, May 9, 2013

Alex Ferguson, Thank You Sir

Ferguson first few years were dicey, much like the first few years experienced by the last 5 Liverpool managers. In actual fact, he was almost booted but turned a corner and has not looked back since then. Continuity is so important and valued in being a football manager, something the modern game can no longer afford, or rather the owners cannot afford. Show me the results within 2-3 seasons or you are out. Molding a team requires time and in Ferguson's case his strategy was most prominent in the way he used the youth system, making it a celebrated channel for bringing up local talents.

In the present days of money buying talent strategy, Manchester United is Manchester United because we can proudly claim a large contingent of home grown talents and still a significant portion of players from the UK, something A LOT of teams cannot claim. At one stage, I though Liverpool was going to change name to Liverpool-Herzagovina.

The New Guy

The bookmakers is giving it to David Moyes, who, I must say has done wonderfully well with a limited budget and slightly above average team. He has shown that he can stick to it for some time. We should want someone who will stay around for at least 10 years. For Manchester United, its not just a manager we hire but a critical new family member.

But my preferred choice from day one has always been Martin O Neil, I think he is a bit more colourful and quite brilliant a manager.

In the present days of money buying talent strategy, Manchester United is Manchester United because we can proudly claim a large contingent of home grown talents and still a significant portion of players from the UK, something A LOT of teams cannot claim. At one stage, I though Liverpool was going to change name to Liverpool-Herzagovina.

The New Guy

The bookmakers is giving it to David Moyes, who, I must say has done wonderfully well with a limited budget and slightly above average team. He has shown that he can stick to it for some time. We should want someone who will stay around for at least 10 years. For Manchester United, its not just a manager we hire but a critical new family member.

But my preferred choice from day one has always been Martin O Neil, I think he is a bit more colourful and quite brilliant a manager.

Wednesday, May 8, 2013

Stocks To Watch

Its a new investment platform following the stop-start-maybe-cautious few months leading up to the elections. As mentioned during the S&M show, there are three tiers in the market, one is the blue blue chips, the second are the stocks that will benefit with the surrounding and prevailing market themes and the third are the fresh names coming up as they may benefit from new projects and investments by states and federal government.

MRCB - Going places, after years of being the neglected child of a large family, this kid is on the way up. EPF's Sungai Buloh project could involve MRCB in a major way.

WCT - Astute operator, like the way they think in hiving off part of the business to do value add. Will be a better and bigger player to watch.

MUHIBBAH - Despite the enormous near limit up surge a couple of months back, this company has more than turned a corner. Many funds are busy accumulating.

INSTACOM - Probably the best backend telco infrastructure player. Tons of work still needs to be done in East Malaysia's connectivity, will be a rising star. Build up in Volume indicates good following.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

MRCB - Going places, after years of being the neglected child of a large family, this kid is on the way up. EPF's Sungai Buloh project could involve MRCB in a major way.

WCT - Astute operator, like the way they think in hiving off part of the business to do value add. Will be a better and bigger player to watch.

MUHIBBAH - Despite the enormous near limit up surge a couple of months back, this company has more than turned a corner. Many funds are busy accumulating.

INSTACOM - Probably the best backend telco infrastructure player. Tons of work still needs to be done in East Malaysia's connectivity, will be a rising star. Build up in Volume indicates good following.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

IDEAS' View Of Elections - "Partially free and not fair"

WAS GE13 FREE AND FAIR?

IDEAS was accredited by the Election Commission of Malaysia (EC) to observe the recently concluded 13th General Elections. Our mandate was to observe, record, analyse and report events leading up to GE13, and subsequently recommend ways to improve any weaknesses found. We benchmarked our observation against the Inter-Parliamentary Union’s Declaration on Criteria for Free and Fair Elections. We deployed 325 observers to 99 parliamentary constituencies in Peninsula Malaysia and 6 overseas polling centres.

Generally, we found that EC successfully ensured the overall process between nomination day and election day proceeded smoothly without any major glitches. Complaints have been filed about the possibility of phantom voters and the failure of the indelible ink to work as it should. Both are important issues that must be addressed. However, we position these two issues in the context of the wider lack of trust in the integrity of the electoral roll, instead of simply a weakness of the EC. In order to address the root cause of the problem, serious attention must be given to improving the integrity of the electoral roll. This involves improving the integrity of the National Registration Department’s database, which may not be within the EC’s purview.

It is important to examine the events building up to GE13 in order to get a better perspective. Taking a long-term view, we saw that (1) The media was heavily biased in favour of Barisan Nasional. State-funded media platforms have been abused to project partisan views to the public; (2) There were doubts about the EC’s impartiality and competency despite their many efforts to improve the electoral system. They were seen as being part of an already biased civil service. The fact that EC members repeatedly issued statements that could be construed as partisan did not help. Their defensiveness when criticised further angered the public; (3) Trust in the integrity of the electoral roll is low. This resulted in the public being very cautious when there were reports of foreigners being flown in, when they saw foreign-looking individuals, or when the indelible ink was seen as ineffective; (4) The Registrar of Societies did not treat all political parties equally, delaying the registration process of non-BN partie; (5) Constituency sizes are too unequal, allowing parties that win many smaller seats to win parliament, despite not commanding popular support; (6) Financing of political parties is not transparent, resulting in a big lack of clarity about the financial standing of the competing parties; (7) During the campaigning period, government and armed forces facilities were repeatedly used for campaigning purposes during the official campaign period; (8) Racial issues were dangerously exploited for political gains. There were many instances of BN fishing for votes by sowing mistrust between the Chinese and Malay communities.

Therefore, although the official campaign period and electoral processes may have proceeded smoothly and with minimal major issues, wider issues that are not within the EC’s purview have built up over the last few years. These issues conspired against non-BN parties, therefore creating a very uneven field. Due to these reasons, we conclude that GE13 was only partially free and not fair.

Tuesday, May 7, 2013

S&M Show Podcasts

This week's topics: equity strategy after election, first tier, second tier and even third tier stocks

http://www.bfm.my/snm-show.html

http://www.bfm.my/snm-show.html

What It Means To Be A Leader & Servant of The People

Can everyone agree that politicians are servants for the people, elected by the people ... can all parties agree on that point? OK, let's move on ... so if there is a WAVE, be it Chinese, rural, Indian, Iban, retards, gays, mixed parentage, single mums ... any kind of WAVE la ... that voted against your PARTY ...

WHY DO YOU AS A LEADER/SERVANT/PARTY FOR THE PEOPLE ... IMMEDIATELY QUESTION THE LOYALTY, QUESTION THE DECISION, CLAIMS THAT THE PEOPLE PART OF THE WAVE WERE UNGRATEFUL???

If your party/leader/members were really servants for the people .... the first thing that should come to your mind is .. WHERE DID WE GO WRONG!!! ... and not point fingers at your citizens!!!

When you accuse, it shows where your heart, motivations and intentions are ...

Why don't you be a servant of the people as all politicians should be, and ask the party themselves "DI MANA KAH KITA DAH MENGECEWAKAN RAKYAT ... menjadikan keadaan begini .... kenapa ada sekelompok rakyat yang berfikir demikian"

(Where did we go wrong, where did we fail our people that caused this group of people to vote against us)

WHY DO YOU AS A LEADER/SERVANT/PARTY FOR THE PEOPLE ... IMMEDIATELY QUESTION THE LOYALTY, QUESTION THE DECISION, CLAIMS THAT THE PEOPLE PART OF THE WAVE WERE UNGRATEFUL???

If your party/leader/members were really servants for the people .... the first thing that should come to your mind is .. WHERE DID WE GO WRONG!!! ... and not point fingers at your citizens!!!

When you accuse, it shows where your heart, motivations and intentions are ...

Why don't you be a servant of the people as all politicians should be, and ask the party themselves "DI MANA KAH KITA DAH MENGECEWAKAN RAKYAT ... menjadikan keadaan begini .... kenapa ada sekelompok rakyat yang berfikir demikian"

(Where did we go wrong, where did we fail our people that caused this group of people to vote against us)

Lots Of Questions, No Answers

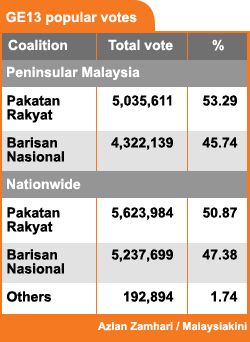

The chart above is why so many questions have risen ....

Bridget Welsh also has her view on the situation below.

Disturbing questions surrounding GE13 polling

By Bridget Welsh | 12:05PM May 7, 2013

Malaysiakini

Malaysiakini

GE13 SPECIAL The GE13 results are in and the BN has managed to hold only power, winning by a 22-seat majority. This result is the worst performance for BN in Malaysia’s history.

GE13 SPECIAL The GE13 results are in and the BN has managed to hold only power, winning by a 22-seat majority. This result is the worst performance for BN in Malaysia’s history.For the first time, the incumbent government has lost the popular vote nationally (in 2008, it was only on the peninsula). The BN coalition has still managed to hold onto power. This piece, in a series analysing the election results, looks at the concerns raised regarding the electoral process and the potential impact these issues may have had on the final results.

In analysing the fairness of any polls, one asks whether the irregularities in the process could have affected the final outcome. Were the problems enough to change which coalition would have formed government? These issues will be debated and assessed in the days and weeks ahead. Let me share some preliminary observations that suggest that in this election, some things appear not to be quite right.

Integrity of electoral roll

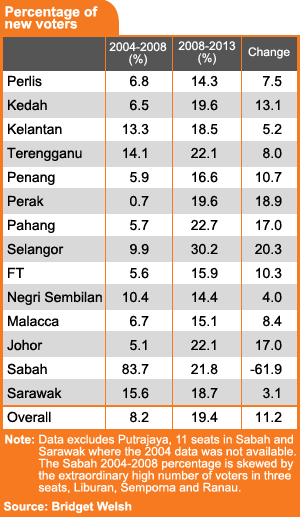

This was the longest wait for an election, and both sides were extremely active in registering new voters, especially in the urban areas where the party machinery was well honed.

Even factoring in the more robust voter registration efforts, changes in electoral procedures to register people where they live rather than where they are from, population demographics, and possible housing developments in different seats, the increased numbers in the electoral roll are significantly not in line with historical patterns of voter registration. This out-of-line pattern is in every state, except Negeri Sembilan.

Even factoring in the more robust voter registration efforts, changes in electoral procedures to register people where they live rather than where they are from, population demographics, and possible housing developments in different seats, the increased numbers in the electoral roll are significantly not in line with historical patterns of voter registration. This out-of-line pattern is in every state, except Negeri Sembilan.

The figure that stands out in voter increase occurred from 2004 to 2008 in Sabah. The questions about the electoral roll in Sabah have been long standing, and are the subject of the ongoing Royal Commission of Inquiry into Immigrants.

These increases from 2004 through 2008 are by any measure – huge – in places such as Liburan, where caretaker Chief Minister Musa Aman state seat is located, in Semporna, the seat of Shafie Apdal and in Ranau currently held by Ewok Ebin.

Yet, after 2008, while the numbers have dropped, there is still on average 21% new voters in Sabah seats, a high number not in line with demographic trends. Migration appears to continue be a factor shaping voter numbers in Sabah in this GE13, despite calls to tighten the flows.

We also find that new voters have flooded states like Selangor, Pahang, Terengganu and Johor in GE13. The average increase in voters nationally between 2004 and 2008 was 8.2%. In the run-up to GE13, the voters registered doubled to 19.4%. The national and statewide averages however obscure the differences among different seats within states. It is clear that some seats have been special recipients of new voters.

Much has been made of the 28% of new voters in Lembah Pantai. This seat is actually on the low side compared to others. Consider the whopping 61.5% increase in Tapah, recently re-won by BN, or Subang with 52% new voters, won by Pakatan with a larger majority this election but shaped heavily by Pakatan’s registration of new voters.

A total of 90 seats, or 41% of all parliamentary seats, have more than 25% new voters. Many of these were in races with tight contests in 2008, and continued to have tight contests in GE13. The new voters has advantaged the opposition in urban areas, but benefitted the BN in rural and semi-rural areas or in states where the machinery of the opposition is comparatively weak, such as Johor.

Such races also won by BN that had large number of voters include Cameron Highlands (20%), Pasir Gudang (39%) and Tebrau (45%) in Johor. While some of the increase in the latter two seats might be explained in part by development, bizarrely there are sharp increases in voting populations in the remote interior state of Pensiangan (33%) and remote coastal seat of Kota Marudu (32%) in Sabah. These abnormal high increases raise questions.

The placement of new voters is even more intriguing when studying the actual polling stations results. Many new voters are concentrated in more less populated areas within constituencies, often in rural and semi-rural seats.

The placement of new voters is even more intriguing when studying the actual polling stations results. Many new voters are concentrated in more less populated areas within constituencies, often in rural and semi-rural seats.This is where the questions over the large number of unexplained voters grouped in bunches in places like Bachok (21% new voters and won by PAS with less than 1% margin) and Bukit Gantang (29% of new voters and won by PAS with 2% margin) come in.

It appears that the localised remote placements of new voters may have had an impact. For example, the placement of 3,600 new voters in a remote Felda schemes occurred in Segamat, which was won by the BN with a 1,217 majority. The voting in this Felda scheme was over 90%, with one stream at 99%. In 2004, the voter turnout in this area was much lower.

This spike pattern of voter turnout in particular polling stations was found in Terengganu in 2004, when the BN wrested back the state, and questions were raised at that time as well.

Spike patterns out of line

This GE13 spike in voter turnout at the local level is being witnessed in specific places across the country. With the national level of turnout at 80%, the spike patterns that are well out of line with historic patterns of voting behaviour raise questions, even accounting for the overall rise in participation and voter turnout.

Another pattern in the placement of new voters beyond tight races involves prominent leaders getting large shares of new voters, such as Najib Razak’s own seat Pekan with 38% new voters, or Rompin represented by Jamaluddin Jarjis at 29% new voters. It remains unclear why these largely rural constituencies would have such large voter increases.

Generally out-migration areas such as Perak and Pahang receiving large numbers of new voters does not conform with population patterns. Why are places with people leaving to work outside get sharp increases in voters?

The lack of clear transparent explanations on why voters are registered in some areas in such high numbers this election, compared to past patterns in these areas, understandably raises questions.

Many seats that were lost by the opposition or were in tight races have large number of new voters, including, including Tanah Merah (24%) and Balik Pulau (25%), although in some cases the opposition picked up or retained seats with large voter increases in these seats, such as Kota Raja (47%) and Kuala Nerus (25%), among others.

This issue of voter registration and voter turnout levels needs further study, with more information on who are these new voters and their pattern of voting. The fact is that the polling station results will show the spikes at the local level and careful study will tell us statistically the impact of these new voters on electoral outcomes.

The Electoral Commission (EC) and electoral administration as a whole are facing a real trust deficit. A reliable electoral roll is essential for any fair elections. Repeatedly questions have been raised about the veracity of many new voters.